About the Irene Hirano and Daniel K. Inouye Legacy Society

The U.S.-Japan Council’s Planned Giving program will help sustain the future of the Council by providing a solid financial foundation. Leave a meaningful legacy while honoring the legacy of the visionary co-founders of the USJC, Irene Hirano Inouye and Senator Daniel K. Inouye.

Join the Irene Hirano and Daniel K. Inouye Legacy Society. Ensure that USJC will continue to strengthen U.S.-Japan relations by developing future Japanese American and other diverse leaders.

Top Reasons to Give Now

BUILD NEW LEADERS

Develop and connect new generations of Japanese American and other diverse leaders.

INSPIRE COLLABORATION

Inspire and enable Americans and Japanese to work together on a people-to-people basis to address and create solutions to mutual concerns.

SHAPE YOUR LEGACY

Leave a lasting legacy that reflects your values and serves as a reminder to your children and future generations.

“My perception of leadership has changed by this program. As a member of the next generation, my dream is to become a medical researcher because I want to help people and create a world where diversity is respected… and I know I can’t change the world alone but I will take small actions for the better. Let’s work together to build a bright and wonderful future together.”

~Ayaka Ueda TOMODACHI Toshizo Watanabe Leadership Program

Legacy Society Membership Benefits:

⊛ Recognition in our Annual Report

⊛ Invitations to special events

⊛ Income tax deduction

Share your legacy. Become a part of the Irene Hirano and Daniel K. Inouye Legacy Society.

Those wishing to leave a legacy gift in Japan should contact the U.S.-Japan Council (Japan), a certified tax-exempt charity organization.

Have questions? Contact us at [email protected].

“My commitment to give to the Irene Hirano and Senator Daniel Inouye Legacy Society is rooted in the gratitude I have for those who’ve gone before me. My hope is that this commitment would play a small role in amplifying the next generation’s impact on the U.S.-Japan relationship for years to come.“

~Josh Morey

USJC Board Member / ELP ‘16

Opportunities to Give

Bequests and Trust Transfers

The U.S.-Japan Council can be named as a beneficiary in your will or revocable trust in several ways. You can specify an outright gift to the U.S.-Japan Council as a designated dollar amount or as a percentage of your estate. You can also make a residuary bequest, where the U.S.-Japan Council is named as a remainder beneficiary and will receive funds after specific bequests have been paid to your other individual beneficiaries.

Gifts of Retirement Assets

Using your 401(k), IRA, pension or profit sharing plan is a tax-wise way to make a gift to the U.S.-Japan Council. Retirement plans remaining in your estate are often subject to both estate and income taxes when received by heirs. In a large estate, the effective tax rate on a retirement plan may exceed 70%, leaving little for your heirs. However, you can designate the U.S.-Japan Council as a beneficiary of a portion or all of your plan. The amount left to the U.S.-Japan Council is both income and estate tax free. To make a gift of this kind, ask your plan administrator for a change of beneficiary form.

Gifts of Life Insurance

A gift of life insurance can provide a significant charitable deduction. You could purchase a new policy or donate a policy that you currently own but no longer need. To receive a deduction, designate the U.S.-Japan Council as both the owner and beneficiary of the life insurance policy. For more details, be sure to consult your legal adviser and work with your insurance agent.

Endowments

You can also leave an endowment to the U.S.-Japan Council which can be funded upon your death or during your life. The income from the endowment would be designated to go to the U.S.-Japan Council for its general purposes or to support a particular initiative. The principal stays intact for perpetuity. It can be set up to honor your family’s memory or can designate someone else you’d like to honor.

Charitable Remainder Trust

Charitable Remainder Trusts benefit donors who wish to retain income from an asset while ultimately giving it to charity. The donor would contribute an asset to an irrevocable trust, naming the U.S.-Japan Council as the beneficiary. The donor would receive specified distributions from the trust for a determined period of time or for the donor’s life. The donor can claim immediate income tax deductions for a portion of the donations and can avoid capital gains taxes on assets that are owned and sold by the trust. After the specified time period has elapsed, the trust assets (the “remainder”) pass to the U.S.-Japan Council.

Charitable Gift Annuity

Charitable gift annuities are similar to charitable remainder trusts, with the exception that the donation is made to the U.S.-Japan Council which, in turn, guarantees the payment of an annuity to you for your life. At the end of the term, what you have contributed to the U.S.-Japan Council is used by the Council to carry on its work. The annuity is a percentage of the amount you donate (typically around 6% per year), and provides you with a charitable income and estate tax deduction.

Charitable Lead Trusts

Charitable Lead Trusts offer the opportunity to involve children and grandchildren in the charitable gifting process, while ultimately transferring assets to your family. The income from the trust is first paid to the U.S.-Japan Council for a specified number of years. After the term is over, the trust assets are passed on to your beneficiaries, typically your children and grandchildren. Depending on the structure of the trust, the donor may be entitled to an income tax charitable deduction, as well as estate tax savings.

This vehicle allows you to “split” a gift or bequest of property between charitable and non-charitable beneficiaries. For example, you can bequeath $10 million to the CLT. The CLT would become effective at death and would name a tax exempt organization as the beneficiary for a period of 20 years. This tax exempt organization can be your own foundation or other charities of your choosing. Each year during the 20 year term, the tax exempt organization(s) would receive an aggregate payment equal to 5% of the fair market value of the trust at the beginning of each year (initially $500,000). On the 20th anniversary of your death, the trust will terminate and the balance of the trust principal will be paid out to your family. Besides providing for charity, the CLT would provide you with an estate tax charitable deduction of about 75%

($7,500,000) of the amount that is used to fund the CLT. This translates into estate tax savings of about $3,750,000.

To ensure that your exact intentions are carried out, wills, codicils, trusts and beneficiary designations should be prepared by and with the advice of your attorney. Refer to the guidelines on the Resources section, which you can discuss with your advisors to make a long-lasting impact on U.S.-Japan relations.

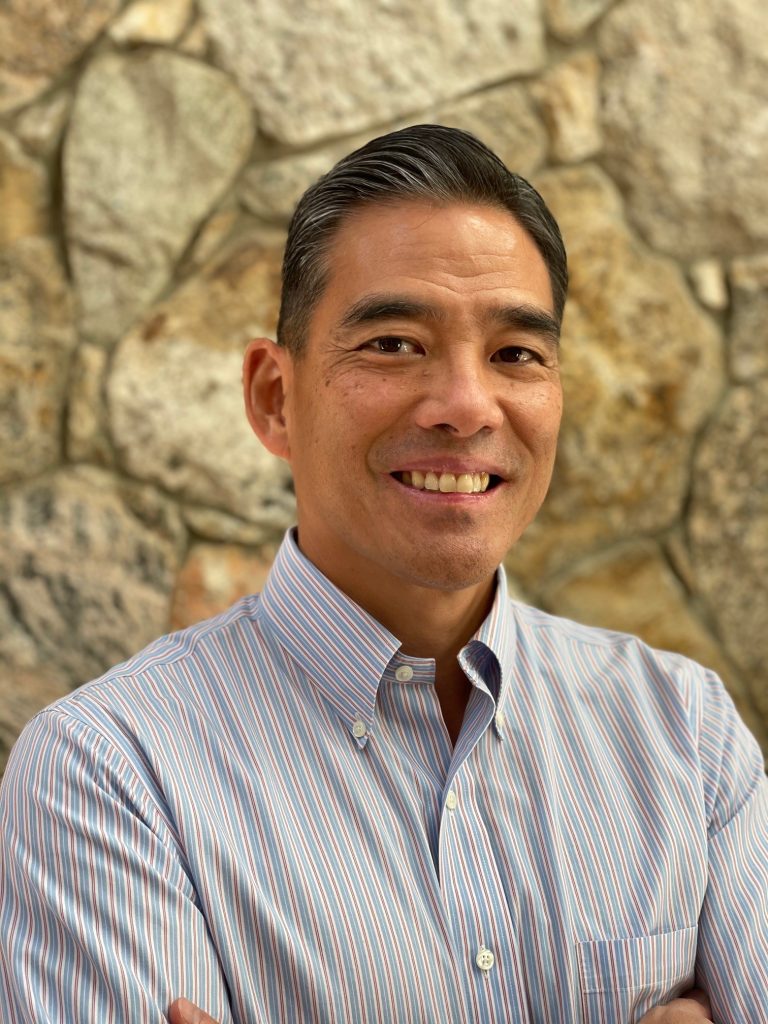

Why I’m Giving:

“The U.S.-Japan Council is truly worthy of philanthropic support. Beyond the bilateral relationship at the macro level, my involvement with USJC has allowed me to reconnect with friends from decades ago and form new friendships with a dynamic, younger generation crowd that will be instrumental in shaping the future of the two countries. With the establishment of the Irene Hirano and Sen. Daniel K. Inouye Legacy Society, it is now possible to make a planned giving bequest to the USJC through one’s 401(k) plan with several mouse clicks. I have done so and humbly urge those who have an affinity to the U.S.-Japan relationship to consider doing so as well.”

~Eiich Kuwana

USJC Board Member

“I have committed my professional life to the U.S.-Japan Alliance and I believe that USJC’s work is the most impactful in fostering next generation support to the bilateral relationship. By including USJC in my planned giving, I ensure that the Council’s work continues into the future.”

~Suzanne Basalla

USJC President & CEO

“When it comes to planned giving and leaving a legacy of support, recognizing the U.S.-Japan Council’s critical mission we wanted to ensure that our support for the mission was enduring. Having spent 8 fantastic years living in Japan we have a great appreciation for the importance of strengthening the ties between the two countries. Providing for the development of future leadership in a meaningful peer to peer organization resonates with us and it is our pleasure to provide a planned giving gift to USJC.“

~Lisa and Randall Chafetz

Resources

Sample Language

“I give and bequeath the sum of $_____ or _____% of my residuary estate to the U.S.-Japan Council, federal tax identification number 90-0447211 and having an address at 1819 L Street, NW, Suite 200, Washington, D.C. 20036, to be used in support of its general purposes.”

“I give and bequeath the sum of $_____ or _____% of my residuary estate to the U.S.-Japan Council, federal tax identification number 90-0447211 and having an address at 1819 L Street, NW, Suite 200, Washington, D.C. 20036, to be used by it to create the _____ Family Fund, a perpetual endowment fund, the income of which is to be paid _____________ for its general purposes.”

Please be sure to consult with your legal and tax advisors to determine the best way for you to give to the U.S.-Japan Council as part of your estate planning.

Major Gifts Program

The U.S.-Japan Council’s mission of developing and connecting next generation leaders is magnified and our impact amplified when we stand together. That’s where your major gift can play a transformational role.

Major gifts are catalysts. Unlike planned gifts that shape our future, major gifts are engines that propel us forward today. Such large contributions are sourced from a donor’s current income or assets. Major gifts provide immediate support that enables USJC to address current needs.

USJC is most grateful for the generosity of visionaries like Michael Lerch, the esteemed founder, president and global chief investment officer of Evolution Financial Group. Learn more about what Michael gave and what motivated him to give to USJC.

Contact Us

If you want to raise your hand with a pledge or a question, please contact us at [email protected].

Organization Name: U.S.-Japan Council

Address: 1819 L Street, NW, Suite 200, Washington, DC 20036

Federal Tax Identification Number (TIN): 90-0447211

Email: [email protected]